Introduction

Banking and finance mainly focus on managing and transferring funds to generate capital and maintain economic growth. Banks are the connecting blocks between people and businesses. It allows them to invest and transfer funds and provides other services like loans, mortgages, and credit cards. Financial terms are simple to listen to, but are they really simple? The terms mortgage-backed security, subprime mortgage, and CDO (Collateralized Debt Obligation) are tricky terms in the world of banking. All of these had their share of investment, which led to the economic crisis/ the doomsday that is depicted in the big short.

Well, this won’t be a complete crisis blog but will discuss a major financial component called commercial mortgage-backed security (CMBS), its functions and types, and its role in the economic crisis.

Get to know more about Commercial mortgage-backed security:

What Are Commercial Mortgage-Backed Securities (CMBS)?

There are two types of loans/products, they are commercial and residential. Commercial mortgage-backed securities are fixed investment loans backed by mortgages. They are given to companies or businesses to buy commercial properties like buildings, malls, hotels, and housing properties. Commercial mortgage-backed security involves a pooled investment that is offered to investors as securities. It helps lenders set free their capital and reduce the risk rate. To improve the field of financing, financial experts introduced the concept of CMBS in the 1990s. The market saw significant growth through the decade and the early 2000s, but the trajectory declined during the 2008 economic crisis.

How does CMBS work?

A commercial mortgage-backed security is in the form of bonds, similar to collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO). A CMBS is made up of loans that provide collateral at the time of default. During an event of default, the principal and the interest amounts are passed on to the investors.

Commercial mortgage-backed security is backed by commercial mortgage loans. These groups of loans are contained in a trust, which combines different properties, terms, and loan amounts. A mortgage loan is considered to be a non-recourse debt. A non-recourse debt means that if a borrower defaults, the lender will only have access to the collateral and not other assets. Given the complexity of CMBS, it is challenging to manage this market and requires a structured process and market members, like investors, trustees, and rating agencies.

Types of CMBS

Commercial mortgage-backed securities are backed by mortgages and are classified into different tranches. Tranches are created from pooled securities like debt investments, which include bonds or mortgages. They are categorized by risk, time to maturity, and other characteristics to provide a market for potential investors.

CMBS tranches are distributed based on the level of credit risk. They are ranked from the highest quality to the lowest quality. The highest quality tranches have the lowest associated risk and receive both interest and principal payments. Whereas the lowest quality tranches have the highest associated risk and are going to have the highest interest rates. However, during challenging scenarios, when there is a potential risk for tranches, they are likely to absorb most of the losses resulting from lowering in rank.

The different types of CMBS tranches are:

- Senior Tranche: Senior tranches are AAA-rated and are the safest tranches. They offer the lowest interest rates and the highest credit. At the time of default, they are the first ones to offer repayment, unlike the other parts of a commercial mortgage-backed security or the A-rated tranches.

- Mezzanine Tranche: Mezzanine tranches also offer higher interest rates than senior tranches, but they are open to potential risks. At the time of default, mezzanine tranches repay the investors only after the investors from the senior tranches are repaid.

- Equity Tranches: Equity tranches do offer higher yields, but they have the highest level of risk. They are the last in line to repay the principal and interest amounts to the investors at the time of a potential default.

Pros and Cons of a Commercial Mortgage-Backed Security

Commercial mortgage-backed securities play a crucial part in finance and banking. They provide distinctive opportunities for businesses to invest in commercial enterprises. Certainly, there is a negative aspect to them, and are discussed below.

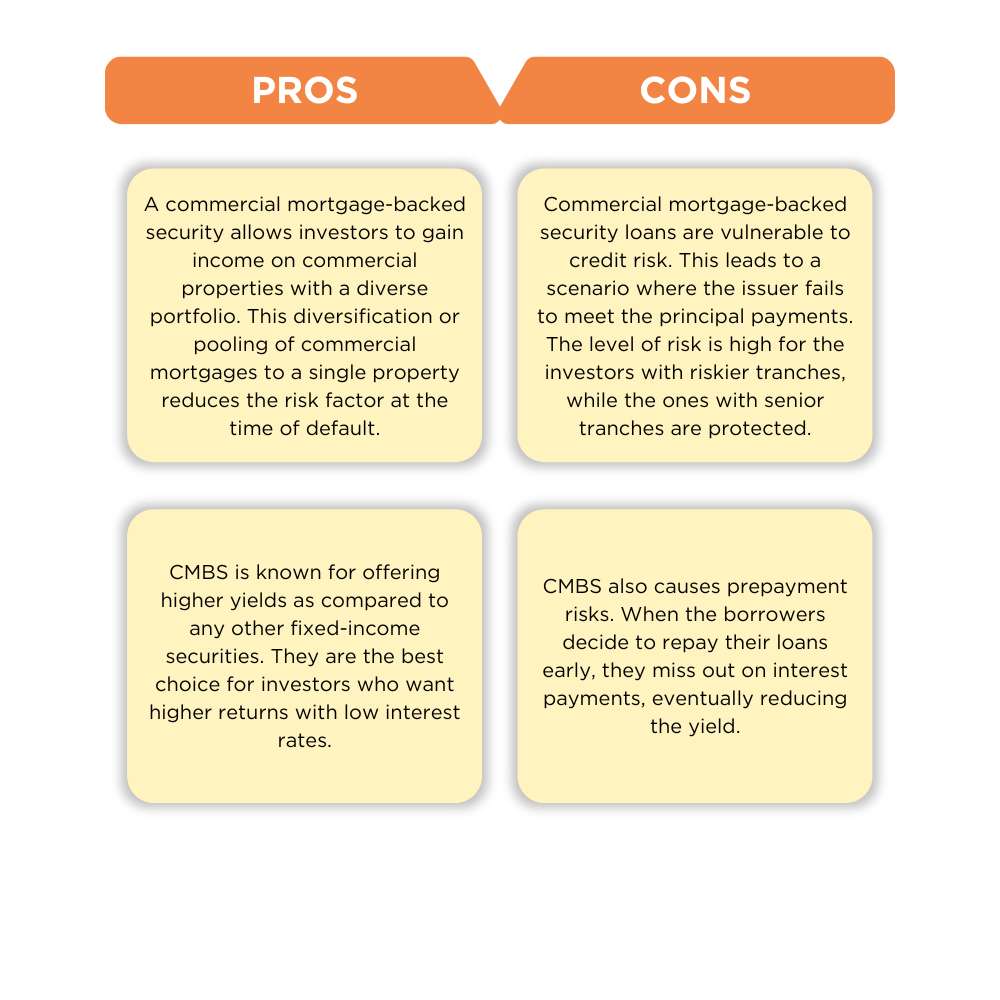

| Pros | Cons |

| A commercial mortgage-backed security allows investors to gain income on commercial properties with a diverse portfolio. This diversification or pooling of commercial mortgages to a single property reduces the risk factor at the time of default. | Commercial mortgage-backed security loans are vulnerable to credit risk. This leads to a scenario where the issuer fails to meet the principal payments. The level of risk is high for the investors with riskier tranches, while the ones with senior tranches are protected. |

| CMBS is known for offering higher yields as compared to any other fixed-income securities. They are the best choice for investors who want higher returns with low interest rates. | CMBS also causes prepayment risks. When the borrowers decide to repay their loans early, they miss out on interest payments, eventually reducing the yield. |

| They provide prepayment protection options and help to protect investors from potential early mortgage payments. | CMBS are subject to legal and regulatory risks. Changes in government regulations and tax laws impact the CMBS market. |

| For investors holding senior tranches, commercial mortgage-backed securities provide downside protection for the properties. There is a scope of full recovery at the time of default. | A defeasance clause is included in some commercial mortgage-backed security contracts. It means that when borrowers try to repay the loans early, they must find a replacement for the lost interest and collateral. |

| Investors can choose the tranche according to their investment motives through CMBS loans. CMBS loans often come with higher fee rates, especially legal fees for borrowers. | CMBS loans often come with higher fee rates, especially legal fees for borrowers. |

Role in The Financial Crisis

The financial crisis of 2007-2008 was caused because of the complex problems that built up over decades. Millions of Americans were impacted by the crisis and saw a steep downfall of many financial institutions. The crisis started with the American housing market bubble. Many banks and financial institutions took advantage of the low mortgage rates. They offered low interest rates on mortgages and persuaded people to take unaffordable loans. With mortgages flowing rapidly, the lending institutions created a financial concept called mortgage-backed security (MBS). They are bundled mortgages backed by credit default swaps (CDS) and were later sold as minimal-risk securities. This bundling of subprime loans resulted in a burst, that is, most of them went into the default phase, leading to the crisis. The role of commercial mortgage-backed security was significant, but it was not the main cause. During the time of the burst, the defaults on commercial mortgages rose, and the CMBS market saw a decline.

Conclusion

Commercial mortgage-backed security (CMBS) is an efficient financial instrument that allows businesses to invest for commercial purposes. CMBS is not harmful, but it is bounded by risky instruments. It offers potential benefits to the investors, but they must understand its functionality. Investors must have a distinct knowledge of mortgages, their different tranches, and the possibility of downfalls before making any financial decisions.