Nvidia continues to dominate the tech landscape, reporting booming data center revenues and staying on track for the launch of its highly anticipated Blackwell GPU platforms. Despite some reported delays in the new generation of GPUs, demand for the company’s current Hopper-based platforms remains strong, allowing it to rake in substantial revenues while addressing production challenges.

Financial Performance at a Glance

For the third quarter of fiscal 2025, which ended in October, Nvidia reported total sales of $35.01 billion, representing a 93.6% increase compared to the same period last year. Operating income surged by 89.2% to $21.87 billion, while net income skyrocketed by 108.9% to $19.31 billion. These impressive results come despite ongoing investments in research and development, share buybacks, and increasing operational costs.

The company ended the quarter with $38.49 billion in cash, a figure that has more than doubled since last year. This financial cushion provides Nvidia with unprecedented breathing room as it continues to invest in future technologies.

Datacenter Revenues Drive Growth

The data center segment remains the primary growth driver, contributing $30.77 billion to Nvidia’s total revenue for the quarter. This marks a year-on-year increase of 2.1x and a sequential rise of 17.1%. Approximately 49.5% of these revenues came from sales to cloud service providers, which generated $15.23 billion. This segment has seen rapid growth as major cloud providers, including Amazon Web Services and Microsoft Azure, continue to expand their GPU-powered AI and HPC infrastructures.

The remaining $15.54 billion in datacenter revenue came from enterprise, government, and academic customers, as well as hyperscalers like Meta Platforms. While both segments more than doubled their revenue year-on-year, cloud services experienced faster sequential growth.

Compute and Networking Breakdown

Datacenter computing continues to dominate Nvidia’s offerings, with revenues from this segment reaching $27.64 billion—up 2.2x year-on-year and 22.3% sequentially. Networking revenues, on the other hand, totaled $3.13 billion, representing a 51.8% year-on-year increase but a 14.7% sequential decline.

Within the networking segment, InfiniBand sales grew 15.2% year-on-year but dropped 27.3% sequentially, generating $1.87 billion. Ethernet networking sales nearly tripled, driven by the adoption of Spectrum-X clusters, such as the one deployed by xAI in Memphis, which connects 100,000 Hopper GPUs. Overall, Ethernet product sales accounted for $1.26 billion in revenue during the quarter.

Blackwell GPUs: Demand and Challenges

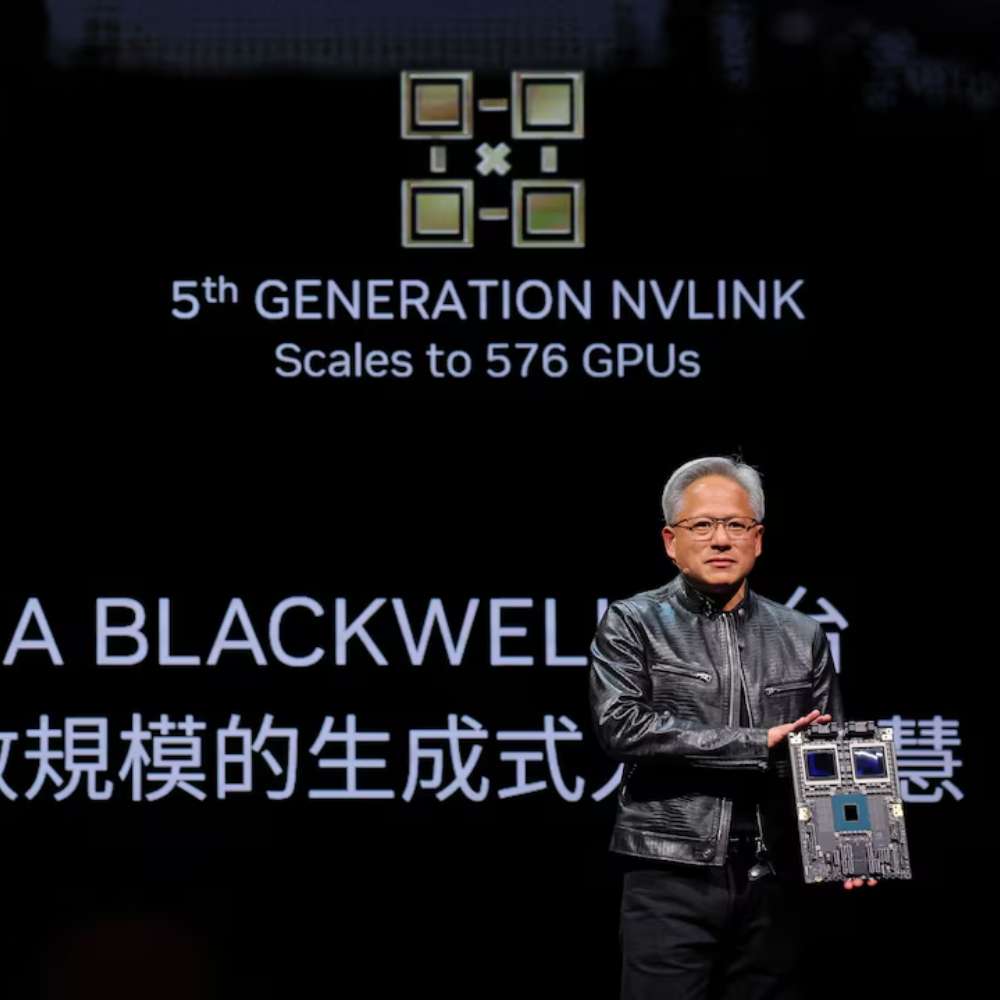

While Hopper-based GPUs like the H100 and H200 continue to perform strongly, the market is eagerly awaiting the next-generation Blackwell platforms. Reports suggest that early production of Blackwell GPUs faced minor delays due to mask flaws and potential overheating issues, but these problems have reportedly been resolved.

The Blackwell GPUs, which promise approximately 1.7x the revenue of Hopper GPUs, are now in full production. Over 13,000 Blackwell GPU samples were shipped to partners during the quarter, with Microsoft Azure expected to launch the first instances based on the GB200 hybrid Grace CPU-Blackwell GPU platform.

The demand for Blackwell GPUs is described as overwhelming, with customers racing to secure orders for the next-generation hardware. These GPUs are designed to power advanced AI models, including those employing post-training refinement with synthetic data and chain-of-thought inference techniques. These developments are pushing the boundaries of AI performance, with next-generation models starting at configurations involving 100,000 Blackwell GPUs.

Nvidia’s CEO expressed confidence in the Blackwell roadmap, stating that everything remains on track. The company has already shipped billions of dollars worth of Blackwell platforms in Q3 and expects these revenues to increase significantly in the coming quarters, potentially surpassing Hopper revenues by mid-2025.

Outlook

With its data center revenues doubling and Blackwell GPUs set to revolutionize AI workloads, Nvidia is well-positioned for continued growth. The company’s ability to balance current-generation success with next-generation innovation ensures it will remain at the forefront of the AI and HPC market.