(Source-Free-Press-Journal)

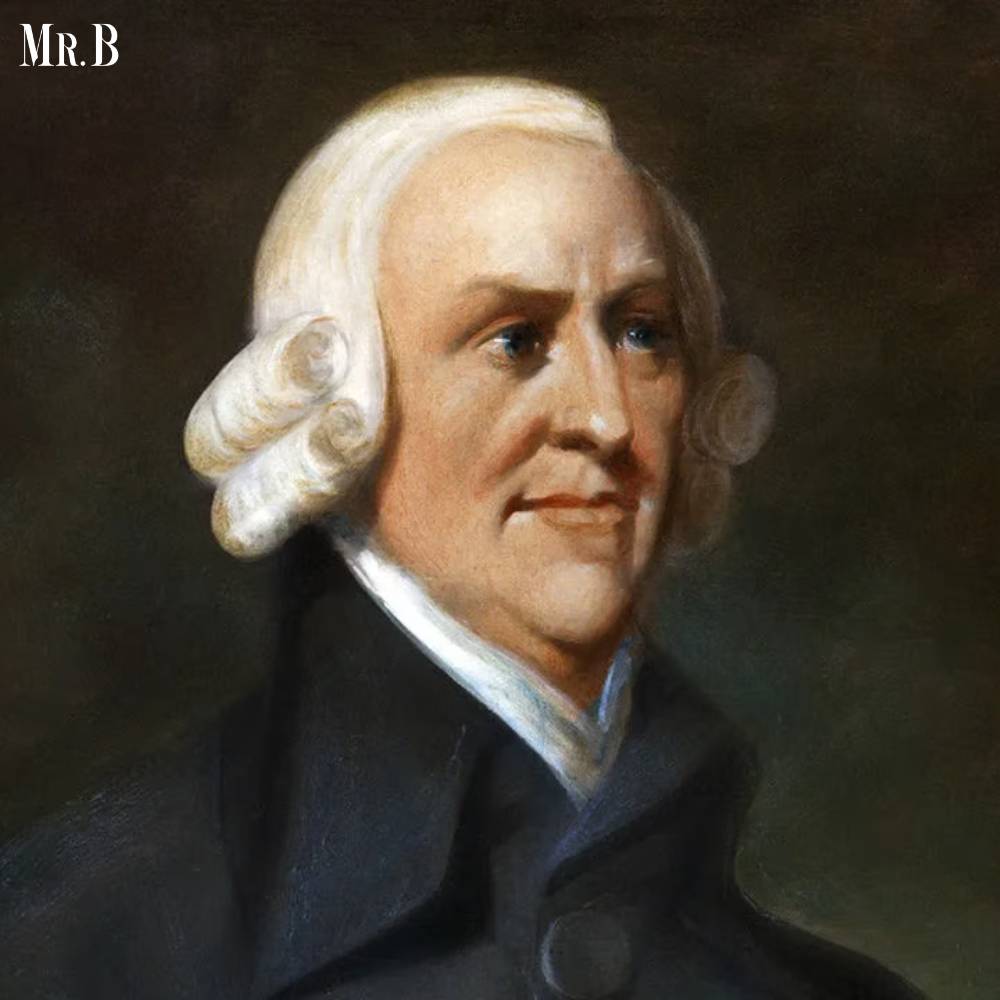

In the intricate web of economic theories, one pillar stands tall, shaping the very fabric of market dynamics – Adam Smith’s Law of Supply and Demand. As we delve into the intricacies of this fundamental principle, we unearth the essence of how markets allocate resources and establish equilibrium. Join us on a journey through the origins, nuances, and enduring relevance of Adam Smith’s groundbreaking theory.

Understanding Adam Smith’s Law of Supply and Demand

Adam Smith, often regarded as the father of modern economics, introduced the Law of Supply and Demand in his seminal work, “The Wealth of Nations” (1776). This economic doctrine postulates that in a free-market economy, the forces of supply and demand interact to determine prices and allocate resources efficiently.

- Supply and Demand Defined

At the core of Adam Smith’s law of supply and demand theory are the concepts of supply and demand. Supply refers to the quantity of a good or service that producers are willing to offer in the market, while demand represents the quantity that consumers are willing to purchase. The Law of Supply and Demand posits that the interplay of these forces establishes an equilibrium price and quantity in the market.

- Equilibrium and Price Mechanism

The equilibrium point is where the quantity supplied equals the quantity demanded. At this juncture, the market achieves balance, and prices stabilize. The price mechanism, a cornerstone of Smith’s theory, operates dynamically, adjusting to changes in supply and demand to maintain this equilibrium. Adam Smith’s law of supply and demand dramatically play with price changes.

- Role of Self-Interest and Competition

Adam Smith’s law of supply and demand presupposes that individuals act in their self-interest. Producers seek to maximize profits by supplying goods at prices consumers are willing to pay. Competition ensures that no single entity can manipulate prices, fostering a market-driven mechanism that benefits both consumers and producers.

- Elasticity and Market Dynamics

The flexibility of Adam Smith’s law of supply and demand lies in its recognition of elasticity. Changes in supply and demand, influenced by factors such as consumer preferences or technological advancements, can lead to shifts in market dynamics. Understanding elasticity allows businesses and policymakers to adapt to changing conditions.

- Government Intervention and Externalities

While Adam Smith’s law of supply and demand advocated for minimal government interference, he acknowledged situations where intervention might be necessary. Externalities, such as environmental impacts, could necessitate government involvement to align market outcomes with societal interests, balancing the sometimes-unbridled forces of supply and demand.

Exceptions to Adam Smith’s Law of Supply and Demand

Like any economic theory, it’s essential to recognize that the real-world application of this law is nuanced. There exist exceptions and complexities that, when understood, provide deeper insights into the functioning of markets.

- Price Controls and Regulations

One prominent exception to Adam Smith’s law of supply and demand arises when governments implement price controls or regulations. In situations where authorities set price ceilings (maximum allowable prices) or price floors (minimum prices), the natural equilibrium can be disrupted. For instance, in times of crisis, governments may impose price ceilings on essential goods to prevent price gouging. While well-intentioned, this intervention can lead to shortages, as producers may find it unprofitable to supply goods at the mandated prices.

- Externalities and Market Failures

Externalities, which refer to the unintended side effects of economic activities, can also disrupt the smooth operation of supply and demand. Adam Smith acknowledged that certain externalities, such as pollution or environmental degradation, may not be adequately accounted for by the market. In such cases, government intervention might be necessary to internalize these external costs and align market outcomes with societal interests.

- Monopoly and Oligopoly Power

The Law of Supply and Demand assumes a competitive market where no single entity has undue influence. However, in situations of monopoly or oligopoly power, where a single or a few large entities dominate the market, the dynamics shift. These powerful players can manipulate prices, impacting the natural equilibrium envisioned by Smith. Regulatory measures are often required to curb such monopolistic practices and ensure fair market competition.

- Inelastic Demand in Necessities

While the law assumes price sensitivity in demand, certain goods and services, deemed necessities, may exhibit inelastic demand. This means that consumers are relatively insensitive to changes in price. Healthcare and prescription medications are examples where consumers may continue to purchase despite price increases, challenging the traditional supply and demand equilibrium.

FAQs

Q1: What is the Law of Supply and Demand?

A1: The Law of Supply and Demand, introduced by Adam Smith, asserts that in a free-market economy, the forces of supply and demand interact to determine prices and allocate resources efficiently.

Q2: How does the equilibrium point work in supply and demand?

A2: The equilibrium point is where the quantity supplied equals the quantity demanded. At this point, the market achieves balance, and prices stabilize.

Q3: What role does self-interest play in the Law of Supply and Demand?

A3: Smith’s law presupposes that individuals act in their self-interest. Producers seek to maximize profits by supplying goods at prices consumers are willing to pay.

Q4: How does the Law of Supply and Demand accommodate changes in market dynamics?

A4: The Law of Supply and Demand recognizes elasticity, allowing for changes in market dynamics influenced by factors like consumer preferences or technological advancements.

Q5: When does Adam Smith suggest government intervention may be necessary?

A5: While advocating for minimal government interference, Smith acknowledged situations where intervention might be necessary, especially in cases of externalities such as environmental impacts.

Conclusion:

As we navigate the complex waters of modern economics, Adam Smith’s law of supply and demand remains a guiding beacon. Its principles, rooted in the dynamics of self-interest, competition, and equilibrium, continue to shape economic thought and policy. By understanding the nuanced interplay of supply and demand, businesses and policymakers alike can harness the wisdom of Smith to foster thriving, balanced economies that stand the test of time.