In the financial sector, prepaid cards have become a popular alternative to traditional bank accounts and credit cards. Given their ease of use and no credit check requirements, they are especially appealing to individuals looking for a straightforward way to manage money. However, like any financial tool, prepaid cards come with their own set of limitations. While they may seem like a convenient option at first, understanding the disadvantages of a prepaid card is essential before making a decision.

This article will discuss the downsides of prepaid cards, focus on the challenges that users may face, and offer insights into whether they’re the right choice for you.

Understanding Prepaid Cards

Prepaid cards function much like debit cards, except they aren’t tied to a traditional bank account. Instead, you load funds onto the card, and you can only spend the amount available. Once the balance is depleted, you need to reload the card before making additional purchases.

For many, this feature makes prepaid cards an attractive option for budgeting, avoiding debt, or providing financial access to those without bank accounts. But while they offer certain advantages, focusing solely on their benefits can overshadow the disadvantages of a prepaid card, which may ultimately affect your financial decisions.

What Are The Disadvantages of a Prepaid Card?

Prepaid cards might seem attractive but they surely have a set of disadvantages.

These Include:

1. Hidden Fees

One of the most significant disadvantages of a prepaid card is the hidden fees that often come with using it. While the concept of pay-as-you-go may sound simple, the reality is far more complex.

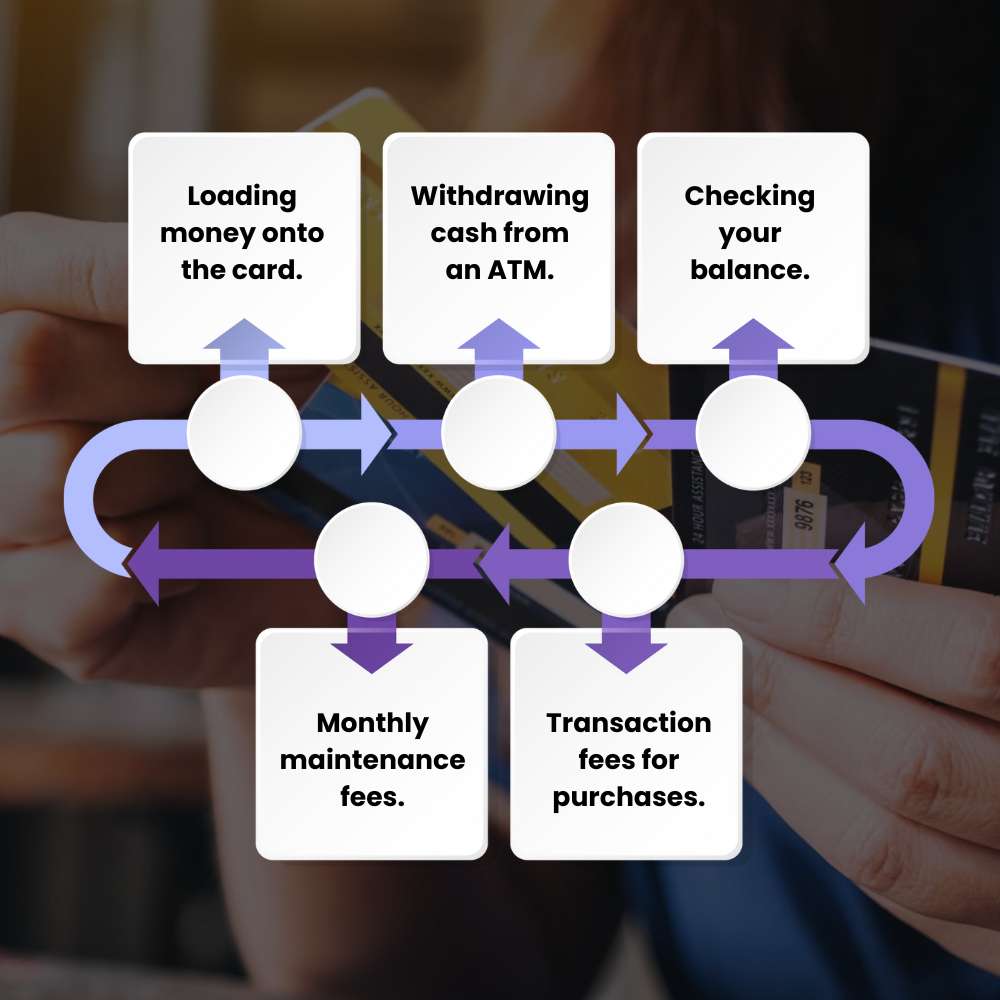

Many prepaid cards charge fees for basic activities, including:

- Loading money onto the card.

- Withdrawing cash from an ATM.

- Checking your balance.

- Monthly maintenance fees.

- Transaction fees for purchases.

These fees can quickly add up, eroding the balance on your card and making it an expensive alternative to traditional debit or credit cards. For instance, some cards charge as much as $5 just to reload funds or $3 per ATM withdrawal. Over time, these costs can outweigh the perceived convenience of the card.

Additionally, some prepaid cards charge an inactivity fee if you don’t use the card for a certain period. This means that even if you’re not actively using your card, your balance can slowly get reduced.

2. Limited Consumer Protections

Another disadvantage of a prepaid card is the lack of consumer protections compared to credit cards or even some debit cards. If your prepaid card is lost or stolen, recovering your money can be challenging. Unlike credit cards, which often come with robust fraud protection, prepaid cards typically don’t offer the same level of security.

Although some prepaid cards offer protection against unauthorized transactions, these features are not universal. And in cases where protection is available, the process of disputing fraudulent charges or recovering lost funds can be time-consuming and complicated. This lack of security makes prepaid cards a riskier option, especially for individuals who frequently use them for online shopping or travel.

3. No Credit-Building Opportunities

For individuals looking to build or improve their credit score, prepaid cards fall short. Unlike credit cards, which report your activity to credit bureaus, prepaid cards do not contribute to your credit history.

This is one of the most significant disadvantages of a prepaid card, particularly for young adults or those with poor credit who are trying to establish a positive financial profile. While prepaid cards can help you manage spending, they don’t offer any long-term benefits.

4. Limited Functionality Compared to Bank Accounts

While prepaid cards can mimic some features of a bank account, they fall short in several areas. For instance, many prepaid cards don’t allow direct deposits or automatic bill payments, which are standard features of most checking accounts.

Additionally, prepaid cards can’t write checks or earn interest on your balance. This limited functionality can be inconvenient for users who want a comprehensive financial solution.

For individuals who rely heavily on digital banking features, such as mobile banking apps or budgeting tools, prepaid cards may feel restrictive. The lack of integration with financial management tools is a disadvantage of a prepaid card for tech-based consumers.

5. Reloading Funds Isn’t Always Convenient

Reloading funds is among the disadvantages of a prepaid card. While the ability to reload a prepaid card is one of its main selling points, the process isn’t always as convenient as it seems. Depending on the card, you may need to visit a specific retailer, use a third-party service, or wait several days for funds to transfer.

6. Usage Restrictions

Another disadvantage of a prepaid card is that it may not be accepted in all situations. Certain merchants, such as car rental companies or hotels, often require a credit card for reservations or security deposits.

While prepaid cards can be used for everyday purchases, their limited acceptance in specific scenarios makes them less versatile than credit or debit cards. This can be especially inconvenient for travelers or individuals relying solely on prepaid cards for their financial needs.

7. Difficulty in Tracking Spending

Unlike traditional bank accounts or credit cards, prepaid cards often lack detailed account statements or online tracking tools. While some cards offer limited access to transaction histories, they may not provide the same level of transparency or organization as a traditional bank account.

This can make it harder to monitor spending, create budgets, or identify unauthorized transactions. For individuals looking to improve their financial habits, this lack of visibility is a notable disadvantage of a prepaid card.

The Bottom Line

While prepaid cards offer convenience and accessibility for certain users, it’s crucial to weigh their downsides carefully. From hidden fees and limited consumer protections to restricted functionality and lack of credit-building opportunities, the disadvantages of a prepaid card can outweigh their benefits for many individuals.

If you’re considering a prepaid card, take the time to compare options, read the fine print, and evaluate whether the card aligns with your financial needs. In some cases, alternatives like secured credit cards, traditional bank accounts, or even digital payment apps may provide better solutions without the same drawbacks.