Investment opportunities are constantly being modified at warp speed, and you must have ample knowledge about them. The banking and finance sector seems challenging if you are unprepared. When it comes to investing, you might stumble at a point, that is, understanding index funds vs mutual funds returns and which one is better offering long-term growth. Choosing between the two can become burdensome if you are not aware of the dynamics. To avoid all the complexities, this blog will help you understand what these funds are, and their key differences, and decide based on your financial goals for better investment returns.

Before getting to the main subject, you must understand how these funds work.

What Are Index Funds?

Index funds are mutual funds replicating components of a specific market index, like the S&P 500 or NASDAQ. They aim to track the performance of a market index, introducing investors to broad market exposure. Index funds offer diversification and come with low fees. Unlike mutual funds, investors cannot hand-pick individual stocks or bonds. This mirroring approach, which represents the difference between the fund’s actual returns and the index returns, leads to a tracking error. Index funds might fail in certain market conditions due to this passive management style.

Benefits of Index Funds

- Diversification

- Cost-Efficient investing

- Potential for high returns

- Easy to track

What Are Mutual Funds?

A mutual fund pools money from multiple investors to invest in stocks, bonds, or other assets. Unlike index funds, these funds are usually actively managed by professional fund managers who aim to beat the market returns by selecting and buying specific securities. This method enables individual investors to invest in a portfolio managed by professionals, potentially reducing costs through economies of scale and avoiding risk by spreading investments across various assets.

Benefits of Mutual Funds

- Regulation and oversight

- Liquidity

- Professional Management

- Diversification

Now that you are informed about how these funds work, let us understand the key factors.

Index Funds Vs Mutual Funds Returns: Which Is Better

Many factors, including your investment strategy or financial goals, influence while deciding on which fund to choose. To make it more concise, here is the breakdown of index funds vs mutual funds returns.

1. Investment Goals

Your investment goals play a significant role in determining your choice between index funds and mutual funds. If your goal is steady, long-term growth with minimal involvement, index funds are often the more reliable option. These funds track market indices and provide predictable, market-aligned returns, making them ideal for investors seeking broad, diversified exposure without active decision-making.

For those aiming for higher growth and willing to accept more risk, actively managed mutual funds may be a better fit. These funds attempt to outperform the market through strategic stock selection, offering the potential for higher returns.

2. Management Costs

The cost of investing impacts the long-term returns of both index funds and mutual funds. Index funds are passively managed, resulting in lower expense ratios. These funds are an attractive option for cost-limited investors looking to minimize fees and maximize their returns over time.

On the other hand, actively managed mutual funds charge higher fees, which cover the costs of research, stock selection, and portfolio management. Despite the potential for higher returns, these higher fees often reduce overall returns, especially over long investment periods.

3. Risk Tolerance

When understanding index funds vs mutual funds returns, you must be aware of the possible risk tolerance of these funds.

Index funds are generally more suitable for cautious investors due to their diversification and lower volatility. They offer a more stable investment option, making them ideal for those seeking consistent, long-term returns. Actively managed mutual funds tend to be more volatile, making them a better choice for investors who can tolerate significant performance fluctuations and are willing to take on higher risks for the potential of greater returns.

4. Investment Perspective

Time horizon is another key factor to be considered when determining index funds vs mutual funds returns. Index funds work exceptionally well for long-term investors, as they align with the market’s natural growth trajectory over time. They are particularly effective for goals like retirement savings or wealth building, where consistency and lower costs play a significant role.

Mutual funds can serve both short and long-term goals, depending on the strategy of the fund manager. However, for long-term investors, the lower costs and steady performance of index funds often make them the more appealing choice.

5. Transparency and Tax Efficiency

Transparency and tax efficiency are important considerations when comparing index funds vs mutual funds returns. Index funds have an advantage in this area due to their straightforward structure. The holdings of index funds are regularly disclosed and remain relatively stable, which increases transparency. Additionally, their low portfolio turnover makes them more tax-efficient, as they generate fewer taxable events over time.

On the other hand, mutual funds often have higher turnover because of frequent buying and selling of securities. This higher activity reduces transparency and results in more taxable events, making them less tax-efficient when compared to index funds.

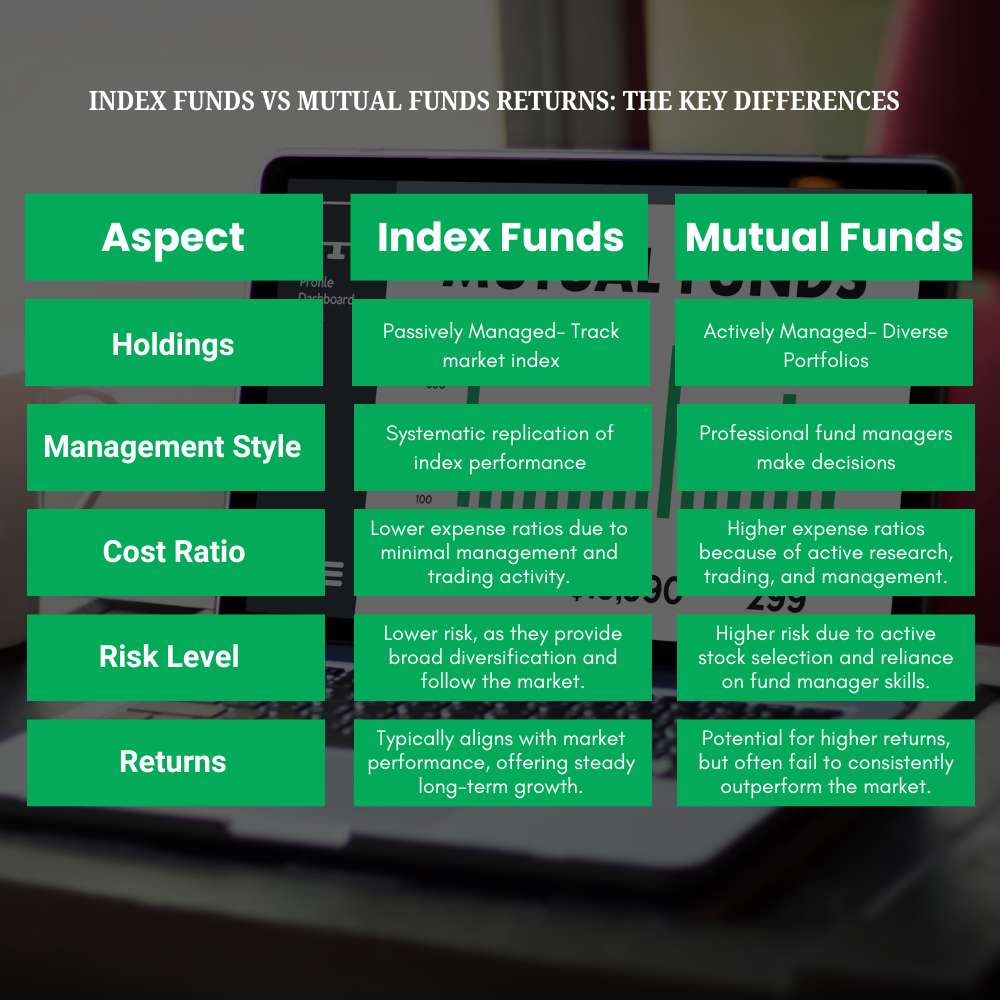

Index Funds Vs Mutual Funds Returns: The Key Differences

| Aspect | Index Funds | Mutual Funds |

| Holdings | Passively Managed- Track market index | Actively Managed- Diverse Portfolios |

| Management Style | Systematic replication of index performance | Professional fund managers make decisions |

| Cost Ratio | Lower expense ratios due to minimal management and trading activity. | Higher expense ratios because of active research, trading, and management. |

| Risk Level | Lower risk, as they provide broad diversification and follow the market. | Higher risk due to active stock selection and reliance on fund manager skills. |

| Returns | Typically aligns with market performance, offering steady long-term growth. | Potential for higher returns, but often fail to consistently outperform the market. |

Summing Up

To conclude on index funds vs mutual funds returns, consider your financial goals, risk tolerance, and investment period. If you prefer steady, low-cost growth with minimal involvement, index funds are a reliable choice that aligns with market performance. On the other hand, if you’re aiming for higher returns and are willing to accept higher risks and costs, actively managed mutual funds could be the better option. Carefully evaluate the potential returns of each to make the best decision for your financial future.