When I first started investing, I thought all I had to do was pick a few stocks and let them grow. I figured the market would keep going up, and I wouldn’t need to worry much about the details. But over time, I noticed that some of my investments had grown a lot, while others hadn’t done so well. My portfolio started to get out of balance, and I realized I was taking on more risk than I was comfortable with.

That’s when I learned about portfolio rebalancing strategies. Rebalancing helped me get my portfolio back on track and gave me more confidence in my choices. In this article, I’ll share some portfolio rebalancing strategies that can help you keep your investments aligned with your goals and risk level.

What Is Portfolio Rebalancing?

Portfolio rebalancing involves adjusting the allocation of assets in your investment portfolio to return to your intended target mix. Over time, the performance of various asset classes (stocks, bonds, real estate, commodities, etc.) causes your portfolio’s allocations to drift away from your original goals. For instance, if your target allocation is 60% stocks and 40% bonds, and the stock market performs exceptionally well, your portfolio may end up being 70% stocks and 30% bonds. This discrepancy exposes you to higher risk than you originally intended.

Rebalancing is necessary to restore balance and ensure your portfolio stays in line with your long-term objectives.

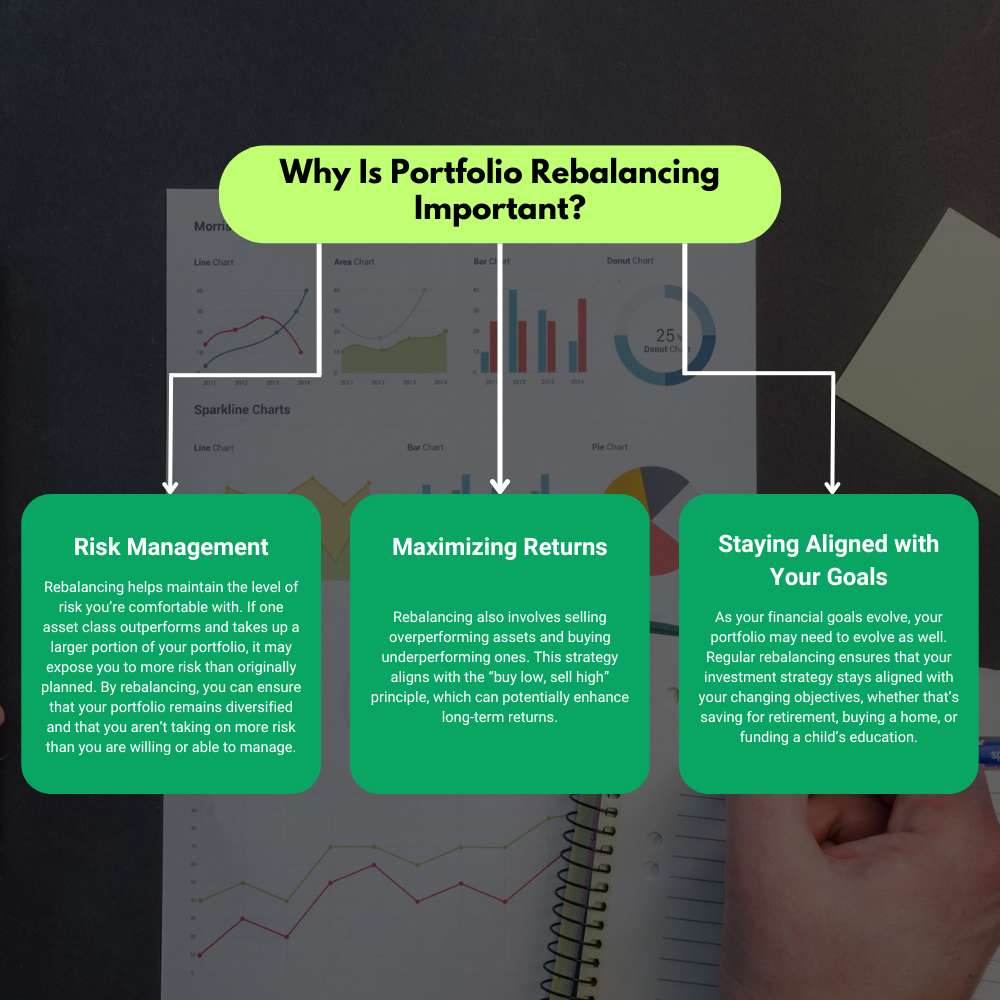

Why Is Portfolio Rebalancing Important?

There are several reasons why portfolio rebalancing strategies are critical for investors:

- Risk Management: Rebalancing helps maintain the level of risk you’re comfortable with. If one asset class outperforms and takes up a larger portion of your portfolio, it may expose you to more risk than originally planned. By rebalancing, you can ensure that your portfolio remains diversified and that you aren’t taking on more risk than you are willing or able to manage.

- Maximizing Returns: Rebalancing also involves selling overperforming assets and buying underperforming ones. This strategy aligns with the “buy low, sell high” principle, which can potentially enhance long-term returns.

- Staying Aligned with Your Goals: As your financial goals evolve, your portfolio may need to evolve as well. Regular rebalancing ensures that your investment strategy stays aligned with your changing objectives, whether that’s saving for retirement, buying a home, or funding a child’s education.

Portfolio Rebalancing Strategies

There are several portfolio rebalancing strategies that investors can use depending on their investment goals, risk tolerance, and personal preferences. Here are the most common strategies:

1. Time-Based Rebalancing

One of the simplest portfolio rebalancing strategies is time-based rebalancing. This involves rebalancing your portfolio at fixed intervals—monthly, quarterly, or annually—regardless of how much the asset allocation has drifted from the target. This strategy works well for investors who prefer a systematic approach and don’t want to constantly monitor market conditions.

For example, if your target allocation is 60% stocks and 40% bonds, you would rebalance your portfolio every year to ensure those ratios are maintained. Even if stocks have outperformed and now represent 70% of your portfolio, you would sell a portion of your stock holdings and buy more bonds to return to the target allocation.

2. Threshold-Based Rebalancing

Threshold-based rebalancing is another popular portfolio rebalancing strategy. With this approach, investors set a tolerance level for how much an asset class can deviate from the target allocation before triggering a rebalance. For example, if your target allocation is 60% stocks and 40% bonds, you may decide to rebalance whenever the stocks or bonds deviate by more than 5% from their target allocation.

For instance, if stocks rise to 65%, and bonds fall to 35%, you would rebalance by selling stocks and buying bonds to bring the portfolio back to the target allocation. This strategy allows you to rebalance more frequently when markets are volatile, but it still provides a degree of flexibility.

3. Cash Flow Rebalancing

Cash flow rebalancing is a more gradual approach to portfolio rebalancing. This strategy involves using new contributions or withdrawals from the portfolio to rebalance the asset allocation. For instance, if you regularly contribute to your investment account, you can use these contributions to buy underperforming assets that have fallen below your target allocation.

Similarly, if you need to make a withdrawal from your portfolio, you can sell assets that have become overweight to maintain your desired balance. Cash flow rebalancing avoids triggering additional tax implications from selling assets and keeps your portfolio aligned with your goals without requiring frequent trades.

4. Dynamic Rebalancing

Dynamic rebalancing involves adjusting your portfolio’s asset allocation in response to changing market conditions or economic factors. This portfolio rebalancing strategy requires a more hands-on approach, where investors actively monitor and adjust their portfolios based on factors such as market volatility, interest rates, or economic growth.

Dynamic rebalancing can be more sophisticated, as it requires a keen understanding of market trends and economic indicators. While it can lead to superior performance if executed correctly, it also involves higher risks and more frequent trading, which can lead to higher transaction costs and potential tax implications.

5. Custom Rebalancing

Custom rebalancing is a more personalized approach to portfolio management. In this strategy, investors customize their rebalancing rules based on their specific investment goals, risk tolerance, and financial situation. Custom rebalancing could involve a combination of time-based, threshold-based, and cash-flow rebalancing strategies to fit an investor’s unique needs.

For example, an investor may decide to rebalance their portfolio every six months, but only if the allocation has deviated by more than 10% from the target. Additionally, the investor may choose to sell only specific asset classes (like bonds) during rebalancing, based on their view of the market.

How Often Should You Rebalance Your Portfolio?

There is no one-size-fits-all answer to how often you should rebalance your portfolio. The frequency of rebalancing depends on factors such as your risk tolerance, investment strategy, and market conditions. However, studies suggest that rebalancing annually or semi-annually may strike the right balance between managing risk and maximizing returns without incurring unnecessary costs.

The Impact of Taxes on Portfolio Rebalancing

When implementing portfolio rebalancing strategies, it’s essential to consider the tax implications of buying and selling assets. Frequent rebalancing can lead to short-term capital gains taxes, which can eat into your returns. One way to mitigate tax consequences is to conduct rebalancing in tax-advantaged accounts (like IRAs or 401(k)s), where trades may be tax-deferred.

Conclusion

Effective portfolio rebalancing strategies are critical for maintaining a well-structured investment portfolio. By ensuring that your asset allocation aligns with your risk tolerance and financial goals, rebalancing can help you manage risk, maximize returns, and stay on track to meet your long-term objectives. Whether you opt for time-based, threshold-based, or dynamic rebalancing, it’s essential to stay disciplined and regularly monitor your portfolio to ensure that it continues to work in your favor.