Introduction:

In the field of personal finance, understanding the difference between simple interest and compound interest is crucial. Whether you’re saving money, investing, or taking out a loan, knowing how these two types of interest work can have a significant impact on your financial outcomes. In this article, we’ll break down the concept of simple interest vs compound interest to help you make more informed financial decisions. By exploring their definitions, formulas, pros, cons, and real-life applications, you’ll gain the clarity needed to decide which type of interest suits your goals best.

What is Simple Interest?

Simple interest is a straightforward method of calculating the interest you earn on an investment or owe on a loan. This interest is based on the initial principal amount and does not take into account any previously earned interest.

The formula for calculating simple interest is:

Simple Interest=P×R×T

Where:

- P = Principal amount (initial amount of money)

- R = Interest rate (annual)

- T = Time (in years)

Let’s look at an example. If you invest $1,000 at a 5% simple interest rate for three years, the interest calculation would be:

Simple Interest= 1000×0.05×3=150

So, you would earn $150 in interest over three years, and your total amount after three years would be $1,150.

Key Characteristics of Simple Interest

- Fixed Interest: Since simple interest is calculated only on the principal, the interest amount remains the same each period.

- Predictable Growth: The total interest earned or owed can be easily calculated without any surprises.

- Ideal for Short-Term Loans: Simple interest is common in personal loans, car loans, and some short-term bonds.

What is Compound Interest?

Compound interest, on the other hand, is more complex. Here, the interest is calculated on the initial principal as well as on any previously earned interest. This means the interest compounds over time, potentially leading to a larger amount than with simple interest, especially as the compounding frequency (monthly, quarterly, or annually) increases.

The formula for calculating compound interest is:

Compound Interest= P×(1+R/n)^(n*T) – P

Where:

- P = Principal amount

- R = Interest rate (annual)

- n = Number of times interest is compounded per year

- T = Time (in years)

For example, if you invest $1,000 at a 5% interest rate compounded annually for three years, the calculation would be:

Compound Interest=1000×(1+0.051)1×3−1000=157.63

So, after three years, you would have earned $157.63 in interest, and your total amount would be $1,157.63—slightly more than with simple interest.

Key Characteristics of Compound Interest

- Interest on Interest: Compound interest earns you interest on both the initial amount and the accumulated interest, making it ideal for long-term investments.

- Higher Potential Returns: Over time, compound interest can lead to significantly higher returns than simple interest.

- Common in Savings Accounts and Investments: Many savings accounts, mutual funds, and retirement accounts use compound interest to help grow your investments.

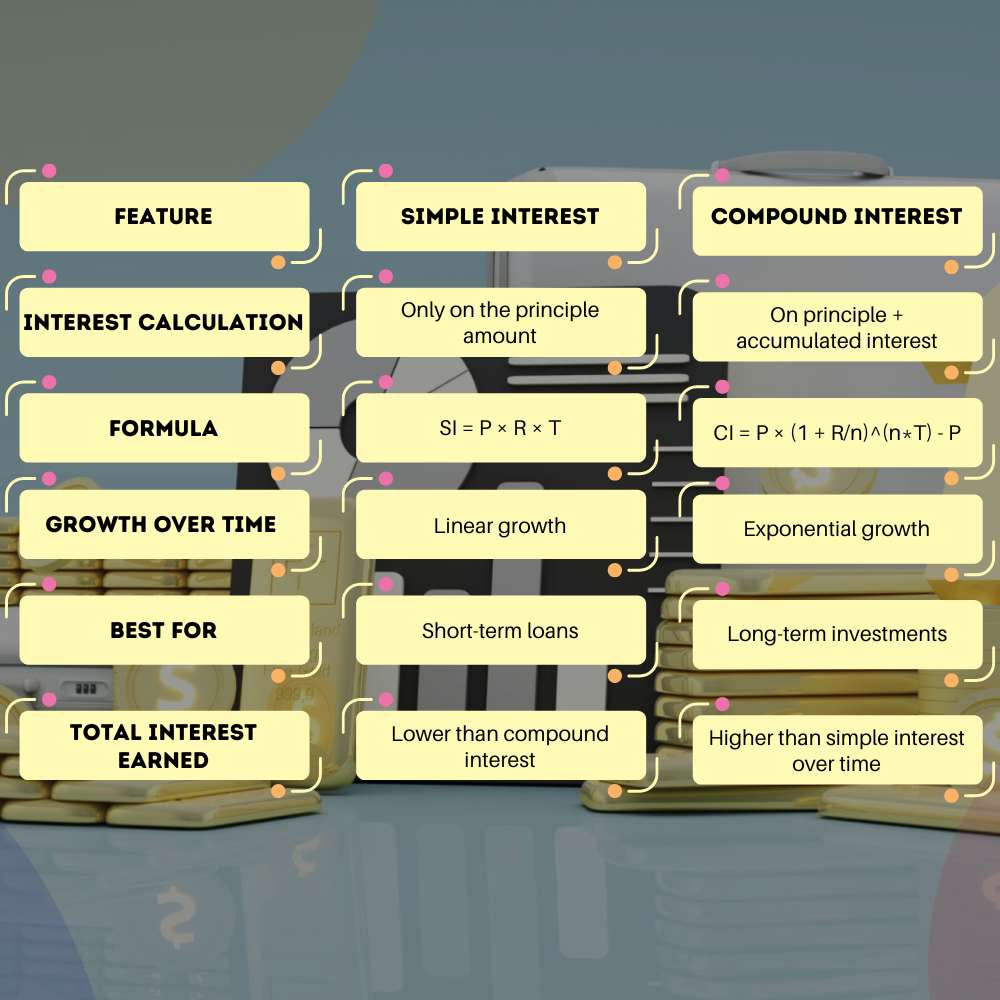

Simple vs. Compound Interest

Simple Interest vs. Compound Interest: Key Differences

Here is the table to make it easier for you to understand the concept of simple interest vs compound interest:

Example Comparison

Suppose you have $1,000 to invest, and you’re comparing simple interest vs. compound interest, both at a 5% rate over 10 years:

- Simple Interest Calculation:

Simple Interest=1000×0.05×10=500

Total amount: $1,500

- Compound Interest Calculation (annually):

Compound Interest=1000×(1+0.051)1×10−1000=628.89

Total amount: $1,628.89

As mentioned above, compound interest has a higher return due to the interest-on-interest effect, particularly as the investment period increases.

Pros and Cons of Simple Interest

Understanding the advantages and limitations of simple interest can help you decide when it’s the right option.

Pros of Simple Interest

- Easier to Understand: Simple interest calculations are straightforward, making it easy to predict total costs or gains.

- Beneficial for Borrowers: Since the interest doesn’t compound, it’s generally cheaper over the long term.

- Predictable: Borrowers can expect how much they’ll owe by the end of a period without any surprises.

Cons of Simple Interest

- Limited Growth: Because the interest only applies to the principal, growth is slow, making it less perfect for investments.

- Not Ideal for Long-Term Savings: Simple interest can reduce potential earnings in savings or investment scenarios.

Pros and Cons of Compound Interest

With its unique method of growth, compound interest is widely used for investments.

Here are the main benefits and drawbacks.

Pros of Compound Interest

- Higher Returns Over Time: Compound interest can yield higher returns than simple interest, particularly over long periods.

- Ideal for Long-Term Goals: Retirement and savings accounts often use compound interest to maximize growth.

- Interest Earned on Interest: This compounding effect accelerates growth, especially with frequent compounding periods.

Cons of Compound Interest

- Can Be Costly for Borrowers: In debt situations, compound interest can increase the total amount owed, which may lead to a debt cycle.

- Complex Calculations: Compound interest can be harder to calculate and predict without financial tools.

- Varies by Frequency: The compounding frequency can significantly impact how much interest is earned or owed, which may not always be transparent.

Real-Life Applications: Simple Interest vs Compound Interest

Understanding simple interest vs compound interest becomes even more easy when applied to real-life financial conditions:

- Loans and Mortgages: Many personal loans and auto loans use simple interest because it’s not complicated. Mortgages and credit card balances often use compound interest, which can make them more expensive if not paid off quickly.

- Savings Accounts and Investments: Compound interest is preferred for long-term savings and investments. For example, a savings account or a retirement fund that compounds interest monthly or annually can lead to substantial gains over time.

- Education and Student Loans: Some student loans use simple interest, making it easier for borrowers to understand their repayment plans. However, other loans may use compound interest, potentially making repayments more challenging if not managed well.

- Business Financing: Companies often take out loans to finance operations. Simple-interest loans are beneficial for short-term needs, while compound-interest loans may be more suitable for growth-oriented projects where returns are expected to outpace interest costs.

Making the Right Choice: Simple Interest vs Compound Interest

Deciding between simple interest vs compound interest depends on your financial goals, timeline, and whether you’re a borrower or an investor.

Important points to remember before choosing the right one:

Choose Simple Interest If:

- You’re taking a short-term loan (personal loan, car loan).

- You want a clear understanding of total interest without compounding.

- You are a borrower who prefers lower interest costs.

Choose Compound Interest If:

- You’re investing for the long term (retirement savings, education fund).

- You want to maximize your returns through the power of compounding.

- You’re saving for a goal far in the future.

Conclusion

To conclude, simple interest vs compound interest may seem similar, but their impacts on your finances are different. Simple interest is predictable, linear, and perfect for short-term financial commitments. On the other hand, compound interest offers exponential growth, making it suitable for long-term investments and savings. By understanding how each type of interest works, you can make smarter choices that align with your financial goals, whether you’re saving, investing, or borrowing.

Don’t Miss Out! Your Next Read is Just a Click Away: Mastering the Formula of Net Income: A Comprehensive Guide