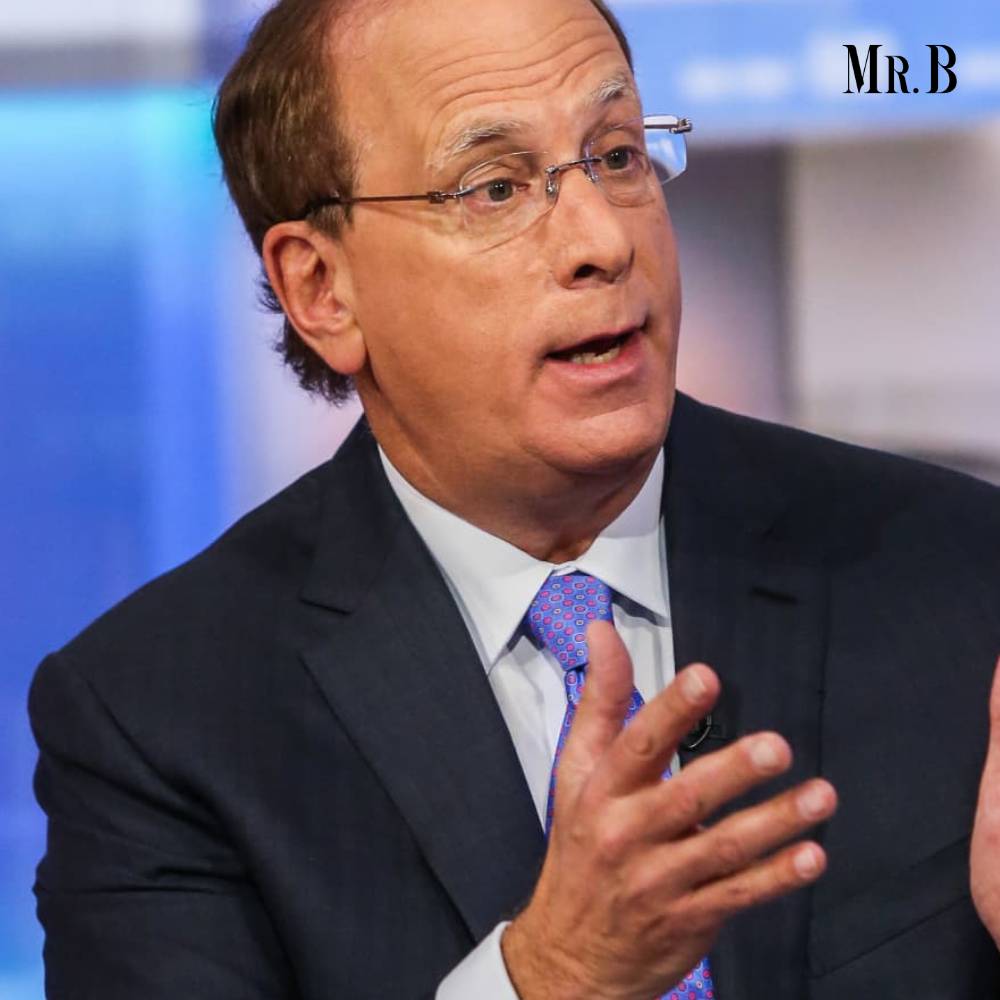

BlackRock CEO Larry Fink Joins Call to Raise Social Security Retirement Age

- Category: News

Larry Fink, Chairman and CEO of BlackRock, has added his voice to the chorus advocating for an increase in the Social Security retirement age. In his annual letter to investors, Fink expressed his belief that while individuals should not be compelled to work longer than desired, the notion of retirement at age 65, originating from the era of the Ottoman Empire, is outdated. While extending the retirement age could alleviate some financial pressure on the Social Security system, it also presents concerns about equity and accessibility to retirement benefits. Individuals in physically demanding or high-stress professions may face difficulties working beyond the traditional retirement age of 65, particularly those with health issues or limited job opportunities.

Demographic Shifts and Financial Realities

Fink’s stance aligns with Republican proposals and demographic realities. Historically, the retirement age was set at 65 when life expectancy was lower, resulting in fewer individuals collecting benefits for extended periods. Today, with longer life expectancies and a surge in the number of baby boomers reaching retirement age, the strain on Social Security’s resources is intensifying. Coupled with projections of the trust fund’s depletion by 2033 and potential benefit cuts, there’s a growing consensus that the current retirement age framework is unsustainable. Addressing these challenges requires a nuanced approach that considers the diverse needs and circumstances of retirees. Addressing these challenges requires a nuanced approach that considers the diverse needs and circumstances of retirees.

Considerations and Controversies Surrounding Retirement Age Reform

While the concept of raising the retirement age is gaining traction, it’s not without controversy. Critics argue that such a move effectively translates to a benefit cut, disproportionately affecting those with health issues or limited job opportunities. Despite opposition, experts like Andrew Biggs from the American Enterprise Institute anticipate an eventual increase in the retirement age, citing precedents from other countries with underfunded pension systems. However, any adjustment would require careful consideration of its impact and the necessity for complementary reforms to address Social Security’s financial shortfall comprehensively. As lawmakers deliberate on potential changes, they confront the complex task of balancing fiscal responsibility with the welfare of retirees and future generations. Policymakers must prioritize measures to support older workers in transitioning to retirement, such as investing in lifelong learning initiatives, promoting flexible work arrangements, and enhancing access to healthcare and social services.

Curious to learn more? Explore this News on: Mr. Business Magazine