(Source – Investopedia)

The Inverted Yield Curve and Its Historical Significance

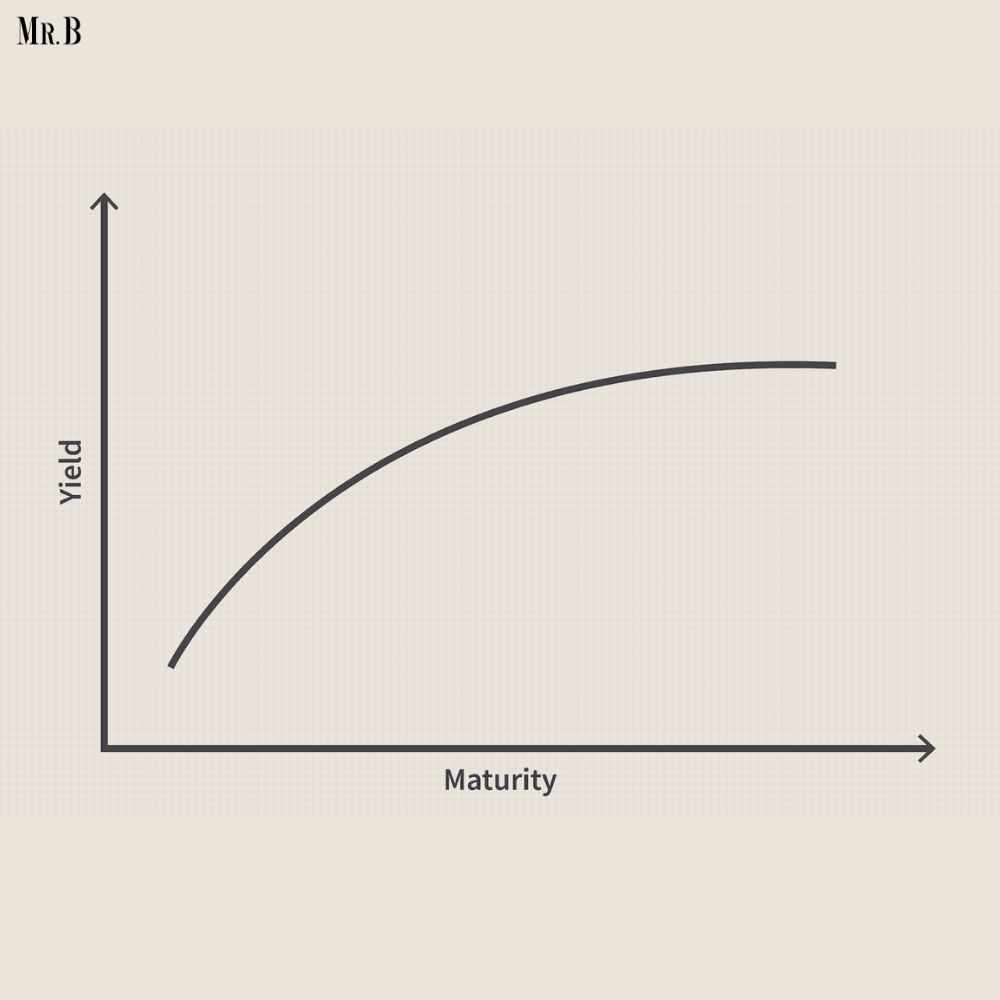

Since 2022, the yield on the 10-year Treasury note has been lower than that on shorter-dated securities, creating an inverted yield curve. Traditionally, this inversion has been a reliable predictor of recessions, accurately foreshadowing nearly every economic downturn since the 1950s. Economists typically expect a recession to occur within one to two years following an inversion. However, this time, the U.S. economy has defied expectations, continuing to grow without a recession in sight.

The prolonged inversion has puzzled Wall Street and economists alike. Mark Zandi, chief economist at Moody’s Analytics, humorously remarked that the curve has been “a bald-faced liar” since it inverted in 2022 without leading to a recession. Yet, he cautioned against complacency, noting that the current inversion might still signal economic challenges ahead. Depending on the chosen comparison duration, the curve has been inverted since July or November 2022, prompting expectations of an impending recession. Historically, the curve has been wrong only once, during the mid-1960s.

A Broken Signal?

The New York Federal Reserve, which relies on the 10-year/3-month yield curve, assigns a 56% probability of a recession by June 2025, based on the current gap. Joseph LaVorgna, chief economist at SMBC Nikko Securities, expressed skepticism about the curve’s reliability, questioning how it could be so inaccurate for such an extended period. Despite his doubts, LaVorgna has not entirely dismissed the curve’s potential significance.

Adding complexity to the situation, other economic indicators also suggest caution. The U.S. GDP has averaged a robust 2.7% annualized real growth since the third quarter of 2022, despite negative growth in the two preceding quarters. Meanwhile, the Sahm Rule, which triggers a recession warning when the unemployment rate rises half a percentage point above its 12-month low, is close to activation. Moreover, money supply has been decreasing since April 2022, and the Conference Board’s leading economic indicators have been persistently negative, hinting at significant economic challenges.

Unusual Economic Dynamics

Economist Jim Paulsen and others have pointed out various factors that might explain why traditional recession signals, including the inverted yield curve, have not played out as expected. Paulsen notes that the economy experienced a technical recession before the yield curve inverted. Additionally, the Federal Reserve’s atypical response to inflation may have affected economic dynamics.

Faced with the highest inflation rates in over 40 years, the Fed began gradually raising interest rates in March 2022, becoming more aggressive by mid-year—post the inflation peak of June 2022. This timing deviated from the Fed’s historical practice of preemptively raising rates early in the inflation cycle and cutting them later. The rate hikes came after companies had already locked in low long-term rates, providing a cushion against rising short-term borrowing costs. This allowed businesses to continue investing and expanding, mitigating the typical recessionary pressures of an inverted yield curve, which usually makes short-term borrowing more expensive and leads banks to lend less.

However, the future remains uncertain. Companies will soon face the challenge of refinancing their debts as the earlier low-rate environment shifts to the current high-rate scenario. This could prompt a recession, aligning the economic reality with the yield curve’s longstanding warning. The situation underscores the delicate balance the Fed must maintain. Zandi from Moody’s warns that the persistent inversion of the yield curve remains a concerning signal, suggesting that the Fed should consider lowering interest rates to mitigate potential risks. As the central bank continues to hold rates at a 23-year high, the economic landscape remains precarious, leaving room for the yield curve’s prediction to eventually come true.

- Curious to learn more? Explore this article on: Mr. Business Magazine