(Source – indusind.com)

Visa and Mastercard are the two biggest names responsible for handling the majority of the world’s card payments. These electronic payment giants are trusted for their speed and security, from local shops to online markets, everywhere. Visa and Mastercard offer a similar set of fundamental features on entry-level credit cards but there is minimal distinction between these two.

In this article, you will learn about the rivalries between the two electronic payment cards, Visa vs. Mastercard, and find which is better for you.

Visa vs. Mastercard: History

To understand the debate between Visa vs. Mastercard, you must first look into the history.

History of Visa

Visa began in 1958 when Bank of America launched the first consumer credit card program, called BankAmericard, in Fresno, California. This card was the first to be accepted by a wide range of merchants, making it easy for people to use.

Visa introduced many technological advancements to improve payment security and convenience. In 1980 they added magnetic stripes to the cards and in 1990, they started using chips for better security. In 2013, Visa introduced online payments, mobile wallets, and contactless cards, making it easier for people to pay how they like.

Visa is currently the second-largest payment card service company in the world. It has around 50% share of total card payments after UnionPay. According to the financial year 2023, the company has issued a total of 4.3 billion cards worldwide. This year they processed a total sum of payment of 212.6 billion USD.

History of Mastercard

Mastercard was created by an association of banks in 1966 to compete with the growth of Visa cards. They wanted to offer a new kind of credit card that could be used at different stores and make the shopping experience easy.

Over the years MasterCard introduced new technologies like magnetic stripe cards, and digital payments, partnered with many companies, and expanded worldwide so you can choose it almost anywhere.

According to the financial year 2023, Mastercard has issued 3.3 billion debit and credit cards, including co-branded cards. Above this they also generate revenue by charging banks a fee to issue cards and when the amount moves to the receiver’s account.

Visa vs. Mastercard: Challenges

The debate about Visa vs. Mastercard is incomplete without the challenges.

- Visa and Mastercard have to constantly protect against cyberattacks to keep transactions safe.

- Visa and Mastercard must keep changing with the advancements in technology like digital wallets, to stay relevant.

- Visa and Mastercard have to face different economic conditions and local competitors as they move into new markets.

- It’s tough to convince small businesses for visas, especially where cash is still popular.

- Each time Visa and Mastercard compete with other payment cards – American Express, and new payment companies to stay ahead.

Visa vs. Mastercard: Comparison

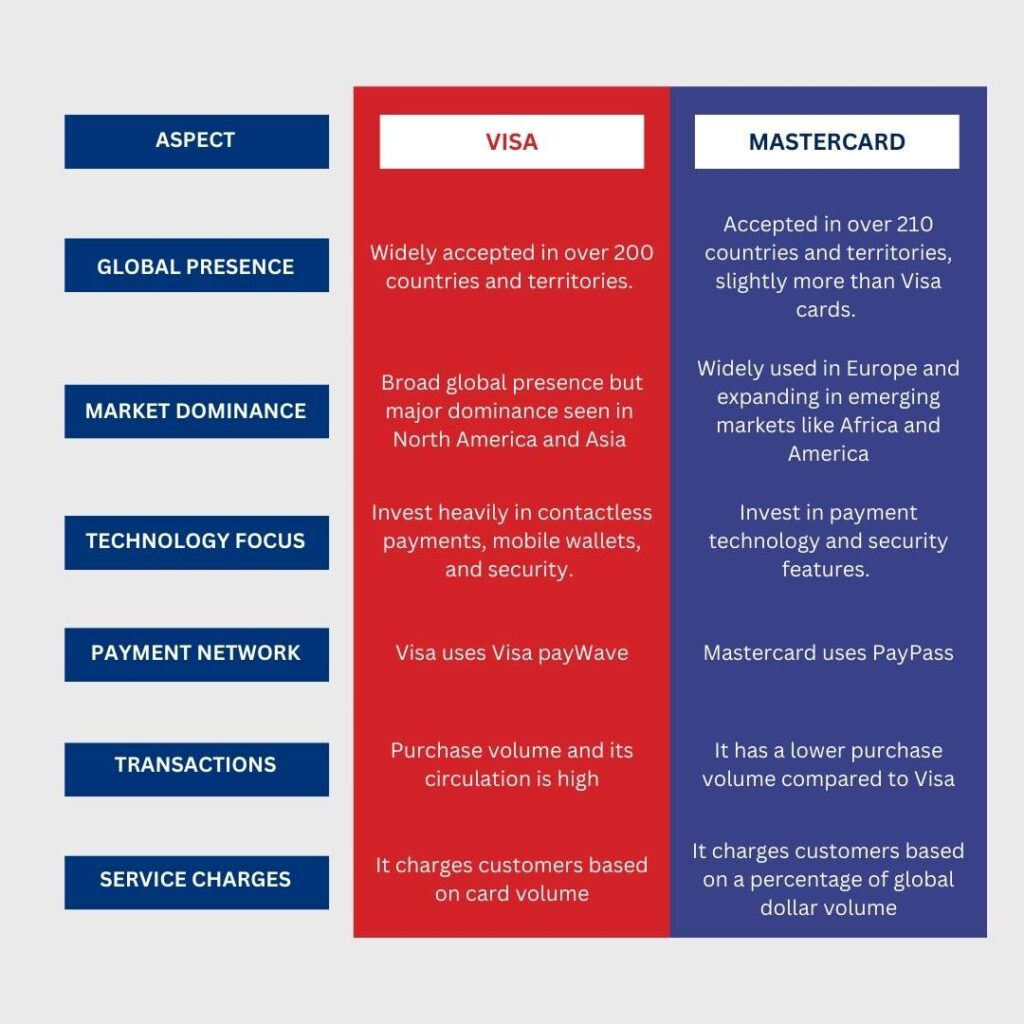

To understand the difference between Visa vs. Mastercard you need to understand them in various aspects.

| Aspect | Visa | Mastercard |

| Global Presence | Widely accepted in over 200 countries and territories. | Accepted in over 210 countries and territories, slightly more than Visa cards. |

| Market Dominance | Broad global presence but major dominance seen in North America and Asia | Widely used in Europe and expanding in emerging markets like Africa and America |

| Technology Focus | Invest heavily in contactless payments, mobile wallets, and security. | Invest in payment technology and security features. |

| Payment Network | Visa uses Visa payWave | Mastercard uses PayPass |

| Transactions | Purchase volume and its circulation is high | It has a lower purchase volume compared to Visa |

| Service Charges | It charges customers based on card volume | It charges customers based on a percentage of global dollar volume |

Visa vs. Mastercard: Benefits

Visa and Mastercard offer almost similar types of benefits. This includes travel benefits, purchase protection and Insurance, and emergency services.

| Benefits | Visa Card | Mastercard |

| Travel Benefits | Privileges when renting carsemergency and travel protection, access to priority pass lounges, discounts at over 900 luxury hotel prices | Lower hotel rates, discounts on car rentals, RV rentals and tickets, exclusive offers, access to golf clubs for lessons and games |

| Purchase Protection | Accident insurance, mobile phone protection, compensation for delays on your trip, reimbursement for lost luggage | Mastercard’s ID theft protection, mobile phone protection |

| Emergency Services | Roadside assistance, quick replacement of emergency cards, access to travel assistance services | Easy reporting for lost or stolen cards, quick replacement of emergency cards, emergency and travel assistance services |

Frequently Asked Questions: Visa vs. Mastercard

1. How is Visa different from Mastercard?

The real difference between Visa and Mastercard is the features and rewards individual cards offer. Visa charges the card issuer per transaction based on card volume. On the other hand, Mastercard charges based on the percentage of global dollar volume.

2. Why are banks changing from Visa to Mastercard?

In comparison to Visa cards, Mastercard offers more additional features that create a huge impact on the customer’s selection.

3. Why Visa is more popular than Mastercard?

If you’re selecting a Visa card, you can access advantages like reporting stolen or lost cards, card replacements, and emergency cash disbursement with a zero-liability policy.

4. Can I use my Visa and Mastercard for Online Shopping?

Yes, Visa and Mastercard are widely accepted for online purchases, offering secure payments to protect your transactions.

5. What should I do if my Visa or Mastercard is lost?

In such cases, immediately report the loss or theft to your card issuer to block the card and arrange for a replacement.

Visa vs. Mastercard: Which One Is Better?

Choosing the better between Visa vs. Mastercard comes down to your understanding of the differences and benefits companies are offering. But one thing is sure whichever option you choose, you will enjoy a seamless experience as they are international market leaders.

Did you find this article helpful? Visit more of our blogs! The Enterprise World