Imagine you have a piggy bank full of candy. That candy is like a company’s money. But what if you borrowed some candy from your friend to buy more? That borrowed candy would be a liability – something you owe to your friend.

Liability in accounting is debts or promises to pay someone back. Companies have lots of liabilities, like money they owe to banks, suppliers, or even their employees. Just like you wouldn’t want to owe your friend too much candy, companies don’t want to have too many liabilities.

In this article, we’ll learn more about liabilities and why they’re important for companies. We’ll talk about different kinds of liabilities, like short-term and long-term, and how they can affect a company’s financial health.

Understanding liabilities: Types and impact on financial health

What is Liability in Accounting?

Liability in accounting is any financial obligation that a business or individual owes to another party. These obligations can stem from loans, supplier contracts, employee wages, or taxes owed to the government. Liabilities are recorded on the balance sheet and are divided into two main categories: current liabilities and non-current liabilities.

For example, if a business takes out a loan to purchase new machinery, that loan becomes a liability because it must be paid back over time. Similarly, unpaid utility bills, wages to be paid to employees, and taxes all fall under liabilities.

Types of Liabilities

Liabilities are classified based on their repayment timelines. The primary categories are current liabilities, which are due within a year, and non-current liabilities, which extend beyond a year. Additionally, there are contingent liabilities, which may or may not arise depending on specific circumstances.

1. Current Liabilities

These liabilities are short-term obligations that need to be settled within one year. They are typically the result of the day-to-day operations of a company. Some examples of current liabilities include:

- Accounts payable: Money that the company owes to its suppliers for goods or services received.

- Short-term loans: Loans that need to be repaid within a year.

- Wages payable: Employee salaries and wages that the company owes but hasn’t paid yet.

- Accrued liabilities: Expenses that have been incurred but not yet paid, like interest or utilities.

- Income taxes payable: Taxes owed to the government that haven’t yet been settled.

2. Non-current Liabilities

Non-current liabilities, also known as long-term liabilities, are obligations that are not due within the next year. These liabilities often fund significant projects or purchases and usually involve larger sums of money. Examples include:

- Bonds payable: Debt securities issued by the company that must be repaid in the long term.

- Long-term loans: Loans or debts that extend beyond a year.

- Mortgages: Loans secured by property that are repaid over time.

- Deferred tax liabilities: Taxes that are owed but will be paid in the future.

- Pension obligations: Money set aside to cover employees’ retirement benefits.

3. Contingent Liabilities

Contingent liabilities are potential obligations that may arise depending on the outcome of a future event. For instance, if a company is involved in a lawsuit, it may have to pay a settlement if it loses. Other examples of contingent liabilities include product warranties and environmental liabilities.

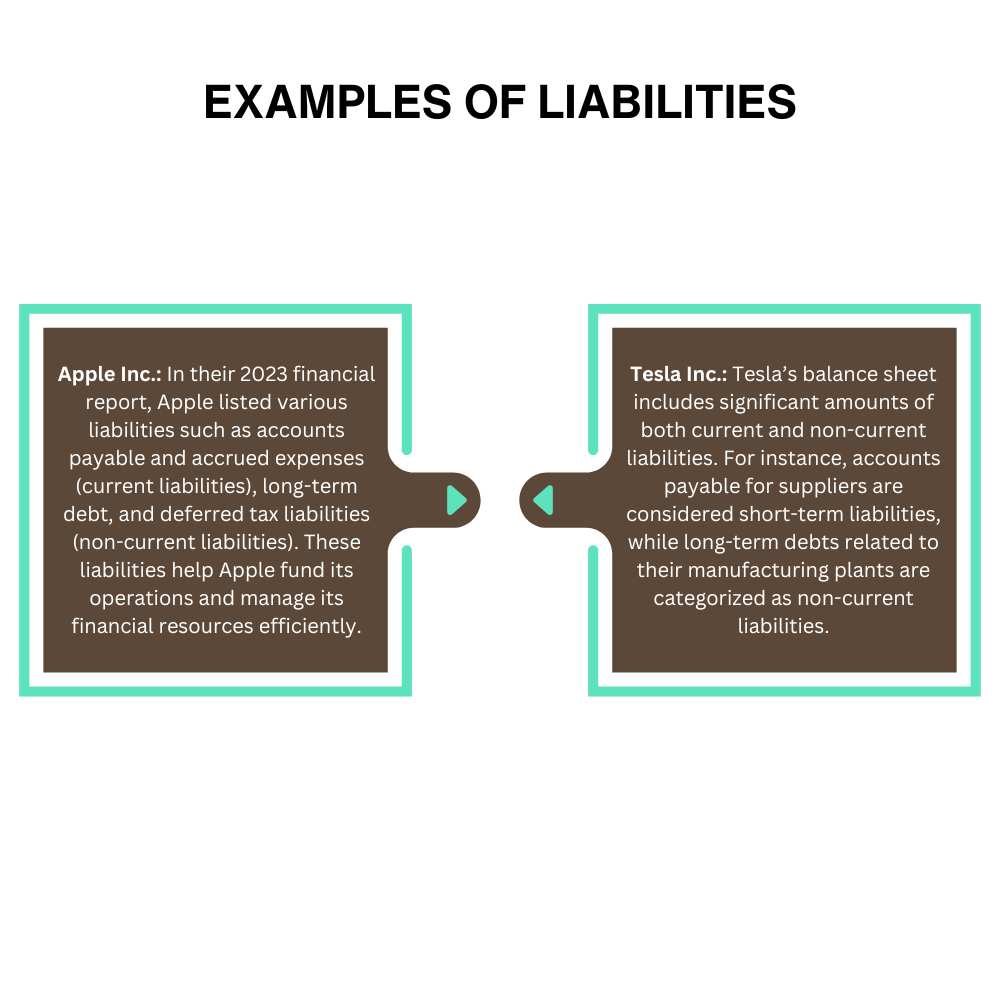

Examples of Liabilities

To better understand liability in accounting, here are a few real-world examples from well-known companies:

Liabilities vs. Assets

While liabilities represent what a company owes, assets represent what a company owns. Assets can include cash, inventory, property, and equipment. Both liabilities and assets are crucial in evaluating a company’s overall financial health.

In fact, the relationship between liabilities and assets is captured in the accounting equation:

Assets = Liabilities + Equity

This equation highlights how a company finances its assets through both liabilities (borrowed money) and equity (owner’s capital or investments). A higher amount of liabilities compared to assets may indicate that a company is heavily leveraged, which could pose financial risks if it struggles to meet its obligations.

Importance of Liability in Accounting

Understanding liability in accounting is vital for several reasons:

- Accurate Financial Reporting: Accurately recording liabilities is essential for generating reliable financial statements. This helps stakeholders understand the company’s financial obligations and its ability to meet them.

- Cash Flow Management: Tracking liabilities allows businesses to manage cash flow effectively. Knowing when debts are due ensures that a company can plan its payments and avoid cash shortages.

- Risk Assessment: Investors and creditors often examine a company’s liabilities to assess its financial health and risk profile. A high level of liabilities may indicate that a company is over-leveraged, which can be a red flag for potential investors.

- Business Expansion: Liabilities are often used to finance growth. Companies may take out loans or issue bonds to fund new projects, expand operations, or invest in technology. However, these liabilities need to be managed carefully to avoid financial strain.

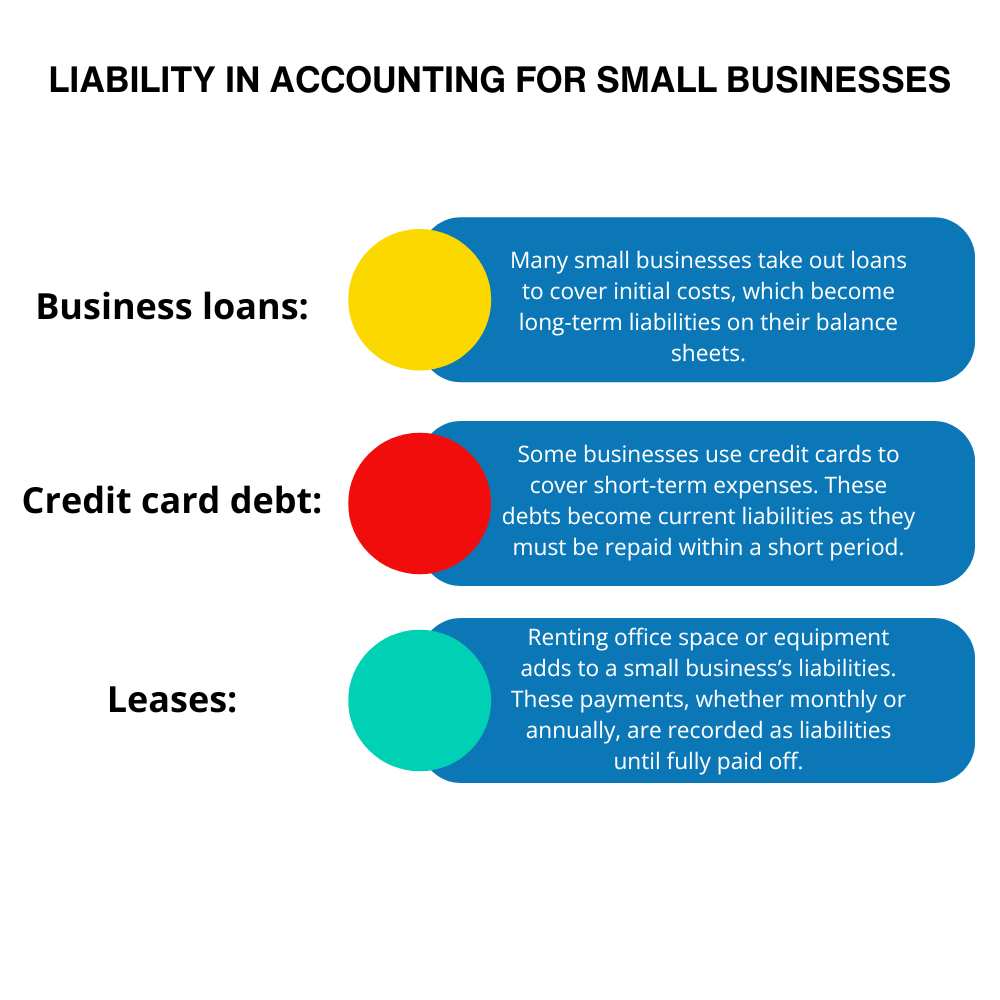

Liability in Accounting for Small Businesses

For small businesses, liabilities can be both a tool for growth and a challenge to manage. Small business owners often rely on loans or credit to fund startup costs, purchase inventory, or expand operations. However, these liabilities must be repaid, which can strain cash flow if not managed properly.

Some common liabilities that small businesses face include:

Reducing Liability in Accounting

Businesses can take several steps to reduce their liabilities and improve financial health:

- Debt Repayment: Prioritizing the repayment of high-interest debt can reduce the burden of liabilities. Companies should regularly review their liabilities and create strategies to pay off debts as soon as possible.

- Improving Cash Flow: By increasing revenue or reducing expenses, companies can generate more cash to cover their liabilities. This helps avoid late payments and penalties.

- Negotiating Terms: Businesses can negotiate with suppliers or creditors to extend payment terms or reduce interest rates, easing the pressure of immediate liabilities.

- Diversifying Income: Generating income from multiple sources allows a business to stay financially flexible and manage liabilities effectively. For example, a company can explore new markets, launch new products, or reduce its dependence on loans.

Conclusion

Liability in accounting plays a crucial role in how businesses manage their finances. From understanding the types of liabilities, such as current, non-current, and contingent, to knowing how they impact a company’s financial health, accounting for liabilities is a vital aspect of financial management. Businesses that carefully track and manage their liabilities can navigate debt, ensure cash flow stability, and even use liabilities as a tool for growth. Proper understanding and management of liabilities are essential to ensuring a company’s long-term success.